What You Should Know About Your Financial Health

Posted in: Economics, Pork Insight Articles by admin on March 28, 2012 | No Comments

Five useful financial ratios for producers are the debt service coverage ratio, acceptable current ratio, debt to equity, operating expense ratio, and loan to security ratio. These are tools that can be used in financial planning and analysis to help make future decisions.

Benchmarking Practises of the Most Profitable Companies

Posted in: Economics, Pork Insight Articles by admin on | No Comments

Benchmarking within the company and between similar producers can help track changes in production, and can help identify areas where savings can be achieved. Agri Stats is a company that will benchmark and prepare monthly audits. Benchmarking allows useful comparisons to be made, and help identify areas that need progress. The most profitable companies use benchmarking, and the key is to have a continuous flow of data and all members of the team accurately reporting data.

Canadian Pork Trade Balance, Outlook and Opportunity Gaps

Posted in: Economics, Pork Insight Articles by admin on | No Comments

Canadian Pork International is an organization working for the export of Canadian pork. They help to maintain market access, which gives Canada a more competitive edge for export. Canada is the third largest pork exporter, and exports 64% of pork production making it the most export dependent country. Global meat consumption is expected to rise, but competition in a global market means Canadian pork needs to cater to consumer demands while remaining profitable. Consumer, end-user customer, and packer-processor demands all have to be considered to maintain a competitive advantage.

Proof of Principle of the Comfort Class concept in pigs. Experimenting in the midst of a stakeholder process on pig welfare

Posted in: Economics, Production, Welfare by admin on August 23, 2011 | No Comments

Animal welfare in livestock systems is strongly dependent on husbandry conditions. ‘Comfort Class’ is defined as a specific minimal level of husbandry conditions of animals, at which the ability of animals to meet their needs is not compromised by husbandry conditions. It is assumed that if this level is attained, animal welfare (the quality of life as experienced by the animal) will not be restricted by husbandry conditions. This idea of a Comfort Class level originates from an early interdisciplinary innovation trajectory in pig husbandry and was adopted by the major Dutch pig farmers’ organisation and the major Dutch animal protection organisation. These two parties built a Comfort Class facility as a proof of principle to test and demonstrate the idea. The aim of the first study in this facility was to empirically test whether a facility that meets the Comfort Class level results in good animal welfare for pigs. In two batches each with 144 undocked pigs, housed in three group sizes, observations were made on tail integrity, skin lesions, activity patterns and degree of synchronisation and clustering of eating and lying behaviour. In the first batch, tail and skin damage was at a low level. The second batch, starting with 64% of the animals having bitten tails, ended with almost all tails recovered. Activity patterns were similar for group sizes and growing stages. Resting behaviour was highly synchronised, but rather spread out over the lying area. Synchronisation of eating was limited, as 52% of the meals were taken alone and a further 29% by two pigs together. The study offered support for the hypothesis, that the Comfort Class level results in a good quality of life for pigs, especially based on the absence of observed welfare infringements (conclusion 1). Results on space use, synchronisation and clustering indicated that the theoretically derived requirements on space allowance and number of feeders might be reduced without compromising the Comfort Class level. The expected limited statistical power of the experiment did not hinder further development, as, during the process, working on the scientific underpinning of the concept was more important than the actual rigidity of the conclusions. The concurrent scientific activities legitimated the stakeholders’ activities and emphasised their claim that practical animal welfare improvement is possible. The project initiated further experimentation and design in practice and contributed to market introduction of welfare improved pork. The methodology applied in the project turned out to be the start of a series of interactive innovation initiatives in animal production sector, leading to the RIO (“Reflexief Interactief Ontwerp”, Dutch for Reflexive Interactive Design) innovation approach. Conclusion 2 of this study is that this interactive approachto experimentation facilitates the implementation of science based welfare improvements in practice.

To view this complete article please visit: http://www.journals.elsevierhealth.com/periodicals/livsci/

Stepwise chilling: Tender pork without compromising water-holding capacity

Posted in: Economics, Meat Quality by admin on August 5, 2011 | No Comments

The current pork slaughter process is primarily optimized to reduce cooler shrink and the incidence of PSE pork. Elimination of the halothane gene and improved preslaughter handling have decreased the incidence of PSE pork and improved the water-holding capacity of the muscle; however, the chilling process has not been optimized to accommodate these changes. The hypothesis that stepwise chilling could improve tenderness without compromising water-holding capacity was tested in this study. The stepwise chilling treatments were composed of a rapid chilling to 10 or 15°C (in a chilling tunnel) and a 6-h holding period at 10 or 15°C, followed by rapid chilling to 4°C. Both treatments were compared directly with a chilling treatment that simulated conventional tunnel chilling; one carcass half from each pig was allocated to a stepwise chilling treatment, whereas the other carcass half was allocated to the control treatment. A total of 42 pigs were slaughtered on 6 slaughter days. Biopsies were collected for analysis of glycogen degradation and glycogen debranching enzyme activity from slaughter until 72 h postmortem, and samples for color, sarcomere length, drip loss, Warner- Bratzler shear force, and sensory analysis were removed from the carcass 24 h postmortem. Substantial temperature differences were obtained during the holding period between the stepwise and conventionally chilled carcass halves. These had almost, but not completely, disappeared by 22 h postmortem, and although the differences were small, pH was significantly less in the stepwise-chilled carcasses compared with the control carcasses. The stepwise chilling treatments led to significantly improved tenderness in LM without compromising quality indicators or attributes such as pH, drip loss, or ham processing yield, although color of the stepwise-chilled pork was affected. Neither the tenderness of processed semimembranosus muscle nor the shear force of biceps femoris muscle was affected because of the smaller temperature differences in these muscles. The improvements in tenderness could be solely attributed to the increased proteolysis postmortem in the stepwise-chilled carcasses, with the greater temperatures favoring proteolytic enzymes involved in muscle protein degradation. Furthermore, the results for glycogen metabolism successfully revealed that both pro- and macroglycogen contributed to the energy generation in postmortem muscles, with degradation of both forms early postmortem.

For more information the full article can be found at http://jas.fass.org/

Glimmer of hope Down Under

Posted in: Economics, Production by admin on July 14, 2011 | No Comments

Australian pig producers have suffered the same problems as their Canadian counterparts, with low hog prices and high feed costs, says consultant John Riley. But now, a weakening of the Aussie dollar and a downward trend in feed costs has resulted in optimism that the worst is over. However, producers need a sustained period of profitability to regain confidence and invest in new technology, he believes.

The number of pigs slaughtered in Australia in June 2008 fell by around 14 % compared with the same period in 2007. The pigs slaughtered totalled just 406,000, the lowest monthly number for well over a decade. The low number of pigs forward has resulted in prices increasing to $2.80 per kilogram for a 75 kg carcass. With an anticipated drop in the national sow breeding herd from 286,000 in June 2007 to approximately 250,000 in June 2008, the industry is hopeful that improved prices will continue through to early in 2009.

The record grain sorghum harvest in Queensland and NSW and promising planting conditions for wheat and barley in the southern states and Western Australia has resulted in feed costs easing downwards slightly. With the northern hemisphere harvest well advanced, producers are hoping that the downward trend in feed prices will continue. If the Australian industry is to avoid further contraction a significant period of profitable production is essential.

Over the last twelve months or so most businesses have increased their liabilities to remain in production and there is a real concern that, as the economic climate improves, financial institutions will put pressure on businesses to reduce their debt load resulting in more producers exiting the industry.

By Australian standards, 2008 has been a long cold winter. On many units, pig accommodation is designed to meet high summer temperatures not low winter temperatures. Most sheds are fitted with cooling systems but not heating systems and in the last quarter improvements in income in the market place and the marginal reduction in the price of feed have been eaten up by poorer feed conversion efficiency in the grower herd and increased pre-weaning piglet mortality.

The fall in the value of the Australian dollar from 98 cents US earlier in the year to currently around 86 cents has had limited effect on the level of processed pig meat reaching Australia. The level of imports from both your country and Denmark have fallen significantly, imports from Canada have fallen by some 6% shipped weight. The expected market opportunities for Australian pig meat have not materialised as the USA have increased their volume landed in Australia by nearly 8% year on year to over 31,000 tonnes shipped weight. The level of exports fell as the Australia dollar almost reached parity with the US dollar. With the fall in the value of our dollar, industry is hoping that export volumes to both Singapore and Japan will increase. It will, however, be a slow process recapturing market share lost to our competitors.

On the home front, the sale of the Hyfarm breeding company’s interests have been finalised and the breeding company in which UK-based JSR Health Bred were a major partner has exited the industry. At the same time as Hyfarm left the industry PIC Australia has purchased a 7,000 sow, farrow to finish unit from Nippon Meat Packers Australia Pty Ltd. The Japanese company, which has a substantial interest in the beef feed lot industry, developed the state of the art piggery in 2000 to supply both the domestic and export market. PIC Australia is owned by the CHM Alliance, whose members also have interests in the poultry industry and cotton production. The acquisition of the Nippon unit at Tong Park in Queensland makes them one of the largest operators in Australia after the 40,000 sow QAF holdings in New South Wales and Victoria.

Australia, as an island, albeit a very large island, is very protective of its animal health status and applies stringent bio-security protocols. There has been no importation of porcine genetic material since about 1990. In the opinion of some experts the policy has resulted in a lack of heterosis in the national pig breeding herd. The average number of pigs weaned per sow in a small sample of herds recorded with the industry’s pork organisation Australian Pork Ltd (APL) is 20.73. On a visit to Holland in July, I had the opportunity to meet with a representative of the international breeding organisation Topigs and visit several of their client’s production units. Arjan Neerhof, the Breeding Program Manager at Topigs, claimed (and his client’s production records confirmed) that commercial units using the Topigs 20 line were averaging 26.8 pigs weaned per sow per year with the top 10% achieving 29.8 pigs weaned compared with an average of 23.5 for the top 10% in the APL sample.

| Topig 20 sample | APL sample | |

| No of herds | 430 | 31 |

| Pigs weaned per litter | 11.3 | 9.16 |

| Litters per sow per year | 2.38 | 2.26 |

| Pigs weaned per sow per year | 26.8 | 20.73 |

The Dutch industry is producing six more weaned pigs per sow per year than Australian producers with the same level of feed usage. If Australia is to compete successfully on the world market, the experts referred to earlier argue that the importation of genetics is a high priority providing our stringent bio-security regulations can be met.

The Australian industry takes great pride in its green and clean image but earlier this year a supply of zinc oxide from China imported on an out of date certificate of analysis, caused a major residue alert in Western Australia. The zinc oxide contained high levels of lead contamination (>85,000 ppm). Tests on pigs fed diets containing the zinc oxide were found to have high levels of lead in red offal which was disposed of, at considerable expense, before it entered the food supply chain.

After months of despondency the rise in pig meat price and the marginal fall in feed price provide a glimmer of hope for the Australian industry. For the industry to regain confidence and invest in new technologies, a lengthy period of profitability is essential.

Industry Crisis – Census confirms producer devastation

Posted in: Economics, Prairie Swine Centre by admin on | No Comments

The April census data showed the extent of the devastation being wreaked in the Canadian pork industry, with almost one-fifth fewer (19.3%) producers than in the same month of 2007. Total pig numbers for the country were down 11.7%, indicating that the exodus was mainly among the smaller producers. Atlantic Canada showed the biggest drop in total pig numbers, with a massive 25.5% drop and Alberta and Saskatchewan both showed a 16.8% reduction. Other than British Columbia’s fall of 6.9%, the lowest drop in numbers was in Quebec, where the ASRA program helps to maintain hog prices.

Table 1: Percentage change in pig numbers – April 2007 to April 2008

CAN AB SK MB

Total pigs -11.7 -16.8 -10.3 -2.0

Breeding stock -4.6 -7.1 -3.3 -1.4

Other pigs

< 20kg -9.6 -15.4 -7.8 -5.3

>20kg -17.2 -19.1 -22.1 -13.7

In the western provinces breeding pig numbers dropped most in Alberta, at 7.1%, while Manitoba had just a 1.4% reduction in sows, gilts and boars. However, in the East, Ontario fell 7.9% while, as might be expected, Quebec was the lowest with 2.9% fewer breeding animals. The under 20kg category showed substantial reduction in numbers in Alberta, BC and Ontario, with -15.4%, -25.2% and -14.4% respectively, while losses were lower in Manitoba (-5.3%), Saskatchewan (-7.8%) and Quebec (-5.0%). Reflecting the huge trend towards shipping young pigs south of the border, Saskatchewan’s pigs in the over 20kg category fell by 22.1% and Alberta’s by 19.1%, while Manitoba’s numbers fell by 13.7%. During the first 3 months of 2008 an estimated 2.9 million pigs were exported, a 25.9% increase over the same period last year. At the same time, domestic slaughter of hogs slipped 1.1%, although this number is likely to increase sharply as supplies of market hogs dry up.

All eyes will be on the July census figures, which are likely to show further reductions. Although anecdotal evidence suggests that the number of producers making the decision to leave the industry is now far fewer, it will likely be another six months before pig numbers stabilize.

Prairie Swine Centre suspends operations at Elstow unit

Reflecting the current malaise in the pork industry, the Prairie Swine Centre announced on May 9th that its PSC Elstow Research Farm would be suspending operations due to the unprecedented losses in the pork business. The unit, a 600-sow farrow to finish barn, designed to support research work in a commercial-style barn, opened in April 2000. The mandate of the facility is to address the needs of the pork industry for research work using a size and scale typical of the commercial industry. Research to address these needs will continue to be the focal point at the remaining Prairie Swine Centre facilities.

Dr. John Patience, President and CEO of PSC Elstow Research Farm, acknowledges the magnitude of the disappointment and distress this decision has on its employees, as well as on the staff at Prairie Swine Centre, and indeed on the broader Canadian pork industry. “The fact that all pork farms in Canada and virtually every other pork producing nation in the world are being devastated by the current market conditions is little solace to the many people who have worked hard to operate the farm and have come to rely on the knowledge generated from the research conducted there”. “We have long-term confidence in the future of the Canadian pork industry as a favoured supplier to meet the growing demand for the world’s most popular meat protein; however the particular circumstances of this barn make it unviable in the short-term. From the beginning, the strength of this business was its mirroring of real commercial production conditions. In the end, these parameters such as debt structure, the devaluation of the US dollar upon which Canadian pork prices depend, unprecedented increases in grain and protein meal prices and underestimating the impact of research functions on an operating farm has resulted in this business decision to suspend operations until conditions improve.”

In spite of this setback, a new initiative started over two years ago is now complete. The $2 million renovation at the original barns located at Prairie Swine Centre will reduce operating costs, making the farm a more competitive pork producer.

Alberta strategy focuses on added value and better marketing

The final draft report on the Alberta pork industry’s revitalization strategy is now completed and details were presented to the province’s pork producers at two open industry meetings at the end of May.

“This strategy is about leading our industry in a new way,” says Herman Simons, Alberta Pork chairman and Tees, Alta. pork producer. “It’s called ‘The Way Forward’ because our industry is in unprecedented distress and we believe that we need to develop new options if pork producers are to survive this distress and have sustained profitability in the future.”

The strategy was developed by Toma and Bouma Management Consultants and the George Morris Centre, who in turn consulted with appropriate resources both nationally and internationally. The first pillar of this broad analysis, a state-of-the-union report, was completed in March and made available to producers. The report, entitled “The Way Forward, The Situation Assessment of the Alberta Pork Industry,” outlined the situation the industry faces and reviews developments from around the world as a basis for evaluating new options.

“The second pillar report, which is just being released, is the actual strategy for moving ahead with repositioning our product in the marketplace,” says Simons. “The Alberta Pork board has reviewed the draft document, but before we move through final approval, we wanted to give producers an opportunity for direct input. This will be important as we work together with industry stakeholders to implement this strategy.”

The strategy vision, he says, is a highly connected pork industry capable of delivering differentiated, high quality, safe pork products in a sustained manner, with the flexibility to respond to continually changing markets and market conditions. The strategy seeks to move the industry out of the highly competitive and unprofitable production of low-cost bulk pork products. Instead, the industry focus will be on producing high-value pork products in demand by consumers in domestic and global niche markets.

The repositioning strategy basically covers four areas, says Simons. First is to establish system integrity in production, processing and marketing to create a highly connected industry through proactively managed supply chains between the processing sector and producers.

Second is to develop new product marketing capability, the establishment of new business-to-business skill sets that develop long-term supply relationships with a set of targeted markets and customers.

Third is to address cost challenges by developing strategies to reduce the two major cost items facing pork production: feed grains and labour.

Finally, the goal is to create a favourable business environment, ensuring that the industry has the necessary public and private services, tools and instruments to successfully compete in a global meat industry.

“We realize this is not an easy path to the future for pork producers and that there are no simple solutions to our challenges,” says Simons. “However, the report has identified several strengths within our industry and we have confidence in the ability of our producers and processors to work toward capturing those in a realistic fashion.

USDA agrees to help US pork producers

The US National Pork Producers Council (NPPC) commended the Bush administration for its decision to lend assistance to US pork producers to help them weather the current economic crisis in the hog business and announced in May. The US Department of Agriculture (USDA) is purchasing up to US$50 million of pork products, which will be donated to child nutrition and other domestic food assistance programmes.

NPPC representatives had previously met with agriculture secretary Ed Schafer to urge him to take immediate action to address a crisis that over the past seven months has cost the pork industry more than $2.1 billion, says a news release from the producer organization.

Economists have estimated that the industry will need to reduce production by at least 10% – meaning a reduction of 600,000 sows – to restore profitability. Such a cutback, however, could result in less-efficient packing plants closing, less manure for crop fertiliser and correspondingly a need for more man-made, foreign-produced fertiliser, a hike in pork retail prices because of a smaller supply and lost jobs, says the NPPC.

“The action by USDA to buy additional pork will benefit America’s pork producers, the US economy and the people who rely on the government’s various food programs,” said NPPC president Bryan Black. “It will help our industry reduce the herd and thereby bring supply and demand back into balance and allow producers to continue to provide consumers with economical, nutritious pork.”

EU production falls and prices increase

There now seems to be some light at the end of the tunnel for European pig producers following a reduction in herd size in most countries. This has now led to strengthening prices, although industry leaders have pointed out that there is still a long way to go before producers are profitable again. Reports predict that pork production within the EU as a whole will be 4.1% lower in the final quarter of the year compared to 2007.

British pig production, with its high production costs, is still under major pressure and sow culling has been running at the highest level in Europe. In January the number of breeding stock slaughtered rose by 46%; in February, the increase in comparison to 2007 was 40% and March saw a growth of 18%. Having halved in size over the last 10 years, the industry looks set to shrink even more.

Prince Charles waded into the battle British producers are having with supermarkets to get a fair share of the retail price of pork. “My heart goes out to all those farmers who are facing such desperate problems as a result of the huge rise in feed costs,” said Prince Charles in a message to the pig industry. “Thanks to the enormous efforts of BPEX (British Pig Industry Executive) and the National Pig Association, there is a growing awareness of the problem, and those retailers who are raising their prices as a result should be congratulated. However, little, if any, of the increase is being passed down the chain to the farmers and, unless urgent action is taken, this country’s pig sector, which has never received subsidies, could be decimated. This would be a tragedy for this country which produces some of the finest quality pigs and which operates according to the highest standards of husbandry and animal welfare,” said the letter.

Spain, the second largest producer of pigs in the EU, is also feeling the pinch, according to pig industry association Anprogapor, which says its members are struggling with rising feed costs. It estimates that 15 per cent of the 70,000 pig producers in Spain have now ceased production. Production costs are currently around €1.20 per kilo of delivered weight, while market prices half-way through 2007 were reaching around €0.90, says a report.

Anprogapor says the situation is unsustainable and that around 200,000 sows have been taken out of production. The result has brought an increase in market prices, but it is not high enough for more farmers to reach profitable levels.

A four-year long drought is exacerbating the situation and provincial governments continue to press for water supplies to be drafted in from neighbouring countries such as France.

Danish producers have always taken a long-term view of the ups and downs of the hog cycle, but their confidence appears to have been shaken by events over the past year. Urged by their industry leaders to stick it out until prices improve, many have decided enough is enough and quit the business. Total pig numbers were down by 10.4% in April 2008 compared with the same month last year, with a similar drop in the number of sows.

Australian shock at lack of government support

Australia’s pig farmers expressed shock when their hope of import safeguards and extra support for the industry were dashed with the publication of the final report to the Federal Government from the Productivity Commission (PC), which was looking into the effect of cheaper imports on the poor profitability of producers.

Australian Pork Limited (APL) CEO Andrew Spencer said that the industry is imploding due to cheap imports of frozen pig meat. Added to this situation is high grain prices that are making local production completely unviable, he said. “To continue to ignore the fact that all of Australia’s pork imports come from countries that actively subsidise their pig farmers and their pork industry with tax payers funds, laughs in the face of fair trading conditions and a free trade environment.” Mr Spencer said 70 per cent of bacon and ham are sourced from overseas countries. Despite the high levels of on-farm efficiencies gained by Australian pig farmers over the past five years, Mr Spencer said the industry cannot compete in “this distorted, totally unbalanced trading environment”.

Alberta Pork tackles labour shortage

Posted in: Economics, Meat Quality, Production by admin on | No Comments

Over the last few years, the availability of skilled labour, or indeed any labour at all, has been an increasing challenge faced by the Alberta pork industry. The only solution for most producers is to recruit foreign workers, but the process is long and cumbersome, resulting in a delay of up to 12 months before a new employee arrives. Alberta Pork has been working with Alberta Agriculture and Rural Development (AARD) and Service Canada since the Fall of 2007 to address producer concerns over this issue.

“As with all the livestock industries, the pork industry’s success is vitally dependent on experienced managers and technicians as well as inexperienced people who wish to pursue a career caring for pigs,” says Stuart McKie, Policy Specialist with Alberta Pork. The lack of available employees in Alberta is not a crisis unique to the pork industry, he notes. “It has come to the point where businesses are cutting back their hours of operation due to a lack of staff. Unfortunately, the livestock industry does not have this as an option except to close its doors completely. Without a dependable labour supply, production units can suffer either in productivity or possibly compromise animal welfare – two unacceptable solutions to this crisis.”

The main delay is the time taken to obtain a Labour Market Opinion or LMO, a prerequisite to hiring a foreign worker. Applications to the Foreign Worker Recruitment Branch of Service Canada have been taking up to 30 weeks to process due to the large numbers received – over 80,000 applications over the last 12 months. However, more recently, processing times have been reduced to about half that time. Following discussions with Service Canada, it has agreed to review applications from producers who find themselves in a crisis situation with regard to labour. “The process involves Alberta Pork handling completed LMO applications from producers,” explains Stuart McKie. “They are then checked to ensure applications are correct and complete prior to forwarding them to Service Canada, providing a means of ‘quality control’, so that all applications are of the required standard.”

The applications are prioritized according to their urgency, with non-urgent applications going into the regular Service Canada administration system and urgent applications being dealt with on a case-by-case basis. Bernie Peet of Pork Chain Consulting Ltd has been contracted to assist with this project and is carrying out the day-to-day work on behalf of Alberta Pork. Alberta Agriculture and Rural Development has provided funding assistance. “Producers are encouraged to plan ahead and apply for an LMO in plenty of time, even if they don’t need a worker immediately,” stresses McKie. “The LMO is valid for six months and there is no fee to pay, so it’s best to have one tucked away for a rainy day.”

With a number of producers going out of business over the past year, some foreign workers have needed help to find new employers, although this still requires an LMO to be obtained because work visas are specific to the employer, the employee and the job. “There’s no shortage of people wanting to employ a worker that’s already here because it’s a quicker process,” says Bernie Peet. “However, the waiting time for an LMO has been the sticking point, but, working with Service Canada, we have been able to rush these through so that the foreign worker has not been left without a job or had to leave the country.” Visa applications are processed at Citizenship and Immigration Canada (CIC) at Vegreville, which is currently taking about a month, he notes.

The second part of the Alberta Pork project is to establish a “database” of foreign workers that is available to producers so that they can select suitable individuals. This is being done by attending overseas Job Fairs, interviewing potential candidates and selecting the best for consideration by producers. In April, Murray Roeske, Alberta Pork’s Field Services Specialist and Bernie Peet took part in a three-day job fair organized by AARD and held in the city of Manila, Philippines. Marvin Salomons and Scott Dundas of AARD coordinated the event, which included three other employers from the food processing industry. More than 1,400 Philippine job seekers attended the venue. Food processing employers interviewed 904 qualified candidates and made 241 job offers on-site. A total of 157 selected job applicants were interviewed on behalf of Alberta pork producers by Peet and Roeske over the three days. “The qualifications of these potential employees were found to be excellent, with a majority of them having a Bachelors of Science in Agriculture degree or are Veterinarians,” comments Murray Roeske. “As English is the second language in the Philippines, all of the interviews were conducted in English and therefore, on-farm communications should not be a problem.” Bernie and Murray returned to Alberta with 111 potential resumes and these are now available for review by producers.

The second part of the Alberta Pork project is to establish a “database” of foreign workers that is available to producers so that they can select suitable individuals. This is being done by attending overseas Job Fairs, interviewing potential candidates and selecting the best for consideration by producers. In April, Murray Roeske, Alberta Pork’s Field Services Specialist and Bernie Peet took part in a three-day job fair organized by AARD and held in the city of Manila, Philippines. Marvin Salomons and Scott Dundas of AARD coordinated the event, which included three other employers from the food processing industry. More than 1,400 Philippine job seekers attended the venue. Food processing employers interviewed 904 qualified candidates and made 241 job offers on-site. A total of 157 selected job applicants were interviewed on behalf of Alberta pork producers by Peet and Roeske over the three days. “The qualifications of these potential employees were found to be excellent, with a majority of them having a Bachelors of Science in Agriculture degree or are Veterinarians,” comments Murray Roeske. “As English is the second language in the Philippines, all of the interviews were conducted in English and therefore, on-farm communications should not be a problem.” Bernie and Murray returned to Alberta with 111 potential resumes and these are now available for review by producers.

Assisting the process in the Philippines was a recruitment agency called Golden Horizon, which has developed a good working relationship with Philippine government organizations and the Canadian Embassy in Manila. This has helped with processing times for visa applications and working with this company has also proved very cost effective in the applicant selection process. Once a candidate has been selected, Golden Horizon ensures that the process of obtaining the work visa goes as quickly as possible, shortening the time taken to get a worker into Canada.

Further job fairs, in Mexico and Europe, will be attended in the near future, in order to maintain and develop a pool of potential workers for the industry. One objective of these overseas missions is to understand the processes involved in obtaining a work visa, especially the potential hold-ups, with the objective of reducing processing times. This involves contact with the Canadian Embassy and organizations in the country being visited that have an influence on the process. “We want to raise our profile and name recognition as a responsible employer, while working to make the process as efficient as possible,” explains Stuart McKie.

Further job fairs, in Mexico and Europe, will be attended in the near future, in order to maintain and develop a pool of potential workers for the industry. One objective of these overseas missions is to understand the processes involved in obtaining a work visa, especially the potential hold-ups, with the objective of reducing processing times. This involves contact with the Canadian Embassy and organizations in the country being visited that have an influence on the process. “We want to raise our profile and name recognition as a responsible employer, while working to make the process as efficient as possible,” explains Stuart McKie.

If you would like more information about the Foreign Worker Project or help with recruiting a worker from overseas, please contact Stuart McKie on (780) 491-3527 or Bernie Peet on (403) 782-3776.

Alberta Pork gratefully acknowledges the assistance and financial support for this project given by AARD and especially the help given by Marvin Salomons, Scott Dundas, Alan Dooley and Ab Barrie.

Photo captions:

1. Registration-1 – A throng of hopefuls waiting to register at the job fair in Manila

2. Murray Roeske – Murray Roeske of Alberta Pork interviews a candidate at the job fair

Survival strategies – When every penny counts

Posted in: Economics, Prairie Swine Centre, Production by admin on | No Comments

Introduction

It is a significant challenge to suggest how a Canadian pork producer in today’s economic environment can turn a loss into a profit. Indeed the “perfect storm” of pork prices, exchange rate and input costs have made losses of $30-$50/hog the norm over the last several months. It is the intent of this paper to reinforce production practices, backed by research and actual commercial practice, that can produce savings of not just $2-3 per market animal but multiples of that. Too often do we hear “I am doing everything possible already” in reference to cutting costs. Production systems are living entities with fluctuations in productivity, management and staff that are overwhelmed with daily distractions and in-barn procedures which evolve whether you want them to or not. There are opportunities, and every dollar saved is one less dollar borrowed under the present conditions. The following is a checklist to take to the barn and help you evaluate where the opportunities exist in your operation.

It is a significant challenge to suggest how a Canadian pork producer in today’s economic environment can turn a loss into a profit. Indeed the “perfect storm” of pork prices, exchange rate and input costs have made losses of $30-$50/hog the norm over the last several months. It is the intent of this paper to reinforce production practices, backed by research and actual commercial practice, that can produce savings of not just $2-3 per market animal but multiples of that. Too often do we hear “I am doing everything possible already” in reference to cutting costs. Production systems are living entities with fluctuations in productivity, management and staff that are overwhelmed with daily distractions and in-barn procedures which evolve whether you want them to or not. There are opportunities, and every dollar saved is one less dollar borrowed under the present conditions. The following is a checklist to take to the barn and help you evaluate where the opportunities exist in your operation.

The focus is on the cost areas with the greatest potential for payback for the efforts invested. These are in order of importance and relative size of annual expenditure: feed (52.7%), wages & benefits 11.2%, and utilities & fuel 4.7%. These three account for nearly 70% of all expenditures on a typical farm in western Canada in 2007, so our approach to addressing costs will be confined to these areas.

Feeding Program

This begins with defining the objective of the feeding program that can be any one of the six objectives in Figure 1.

Figure 1: Objectives of a feeding program

1. Maximize return over feed cost/pig sold

2. Maximize return over feed cost/year

3. Maximize expression of genetic potential

4. Achieve specific carcass characteristics

5. Achieve specific pork characteristics

- Minimize operational losses

Action #1: Feeding program objectives must be clearly defined;

Objectives can and indeed will change over time |

The purpose of defining the program makes it possible for the nutritionist to assist in diet formulation and ingredient selection to achieve that end. So the first opportunity for cost reduction is – Are we formulating to minimize operational losses? This includes a review of selecting optimum energy levels, defining lysine:energy ratios, defining the ratio of other amino acid levels to lysine, setting mineral levels (even withdrawing in late stage finisher diets) and making use of opportunity ingredients. The outcome should be a feed budget similar to Figure 2. The regular matching of actual feed usage by diet type to the budget is the exercise in Figure 3 which shows that after a 5 month period in fact this 600 sow farrow-to-finish farm had excessive use of some of the most expensive diets on the farm and resulted in an average cost increase of almost $6 per market hog. But the owner thought they were doing “everything they could” because they had a competitive feed budget. The problem was not the budget but the fact it was not being adhered to for any number of reasons, perhaps as simple as not explaining to the person making or delivering the feed that the number of pigs in the nursery was below budget, in this case because of a PCVAD outbreak.

Figure 2: Example of a typical western Canadian feed budget

Diet Pig Wt., Days A.D.G., A.D.F.I., Feed,

kg g/d g/d kg/pig kg.pig kg/pig

St #1 6 4 115 125 0.5

St #2 7 to 8 6 300 330 2.0

St #3 8 to 14 13 475 620 8

St #4 14 to 22 13 600 870 11

St #5 22 to 35 17 765 1,224 21

Gr #1 35 to 50 16 865 1,900 31

Gr #2 50 to 65 16 920 2,300 38

Fi #1 65 to 80 16 930 2,600 46

Fi #2 80 to 95 16 930 2,850 46

Fi #3 95 to 105 11 880 3,000 38

Fi #4 105 to Mkt 12 830 3,000 32

Figure 3: Reconciliation of actual feed usage versus budget

Diet Budget Actual (5 month avg)

Wean diet 2.5 3.3*

Starter 1 8 9.1*

Starter 2 11 12.8*

Starter 3 21 23.4*

Grower 1 31 40.1*

Grower 2 38 43.3*

Barrow fin1 46 41.6

Barrow fin2 46 42.9

Barrow fin3 38 43.1*

Barrow fin-mkt 32 46.5*

Gilt fin1 46 48.0

Gilt fin2 46 46.6

Gilt fin3 36 46.1*

Gilt fin-mkt 30 47.4*

Gestation 37 18.1

Lactation 22 18.3

Cost/pig marketed $83.42 $89.35

Difference $5.93

Numbers in RED* are greater than 10% over budget

Other aspects of the feeding program that need to be evaluated include evaluating the energy content of the final diets and implementing the Net Energy system to seek further savings by crediting the most accurate energy value available to each ingredient. Reformulating frequently is important when commodity prices move up or down. The general “rule of thumb” is to reformulate whenever the main grain and protein ingredients move by a pre-determined amount (for example $5-10 per metric tonne).

Alternative feed ingredients at times can be the single largest opportunity to reduce feed costs. This includes co-products of the ethanol, bakery and food processing industry but also includes common ingredients like corn. Currently in western Canadian diets implementing a change from wheat to corn could save as much as $4-5/pig marketed depending on your local cost of wheat.

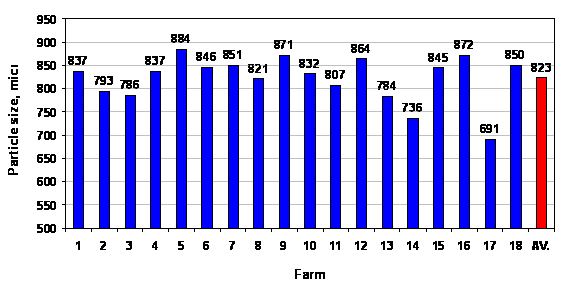

Once the diet has been formulated there are still opportunities to reduce costs by observing particle size stays within the 650-700 micron range to ensure optimum digestibility. Frequently, due to screen wear, improper screen size or hammer wear, the feeds milled on farm are significantly over the 700-micron threshold (surveys show a range of particle size 700-900 microns – Figure 4). For every 100 microns under 700 the feed conversion improves 1.2%. With feed costs today of $80 per finished hog, moving from say a 3.0 F/G to a 2.96 F/G (the effect of 1.2% improvement, or 100 micron reduction in feed particle size) is worth $1.00 per pig marketed.

Figure 4: On-farm survey of average feed grain particle size

| Target of 650 um |

From: Stirdon Betker, Alberta

Please view our Survival Strategies publications on our website www.prairieswine.ca for more tips like:

- Moving from 2 phases to 4 phase feeding programs can easily save $1-2/pig

- Trace minerals and vitamins can be removed from last three weeks of finishing diet (not for gilts for breeding or pigs on Paylean)

- Use of phytase and reduction of dicalcium phosphate in diet has saved $0.50 per pig or more under some market conditions

Labour

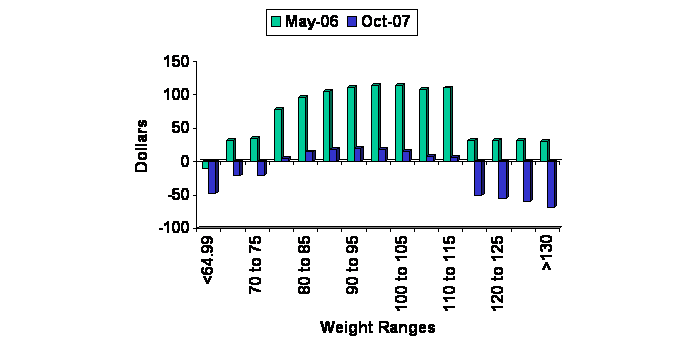

Which is more important – breeding sows or shipping pigs? Although the question is not really which is more important, it does point to the two areas where our people have a significant impact in our success as a production unit. Figure 5 shows one farm’s analysis of how management and labour have to respond when market conditions change. The most profitable hog in May 2006 provided a carcass of 100-105 kg whereas that same farm maximized returns by dropping carcass weights 5kg in October 2007 in response to declining hog prices and increasing feed prices. Once the new target is established, consistently hitting the target is important. Unfortunately many packers still report that only 66% of the hogs they receive fall into “core”. This is unfortunate since weighing, marking and forecasting growth rates should allow the personnel to hit 85% in core consistently. The loss due to this slippage is approaching $2.00 per hog marketed.

Figure 5: On farms analysis of carcass weight relative to returns at two time periods

Action #8: In May, 2006, return over feed cost was maximized in carcasses weighing 100 to 105 kg; in October, 2007, returns were maximized in carcasses weighing 95 to 100kg

Utilities

Utilities are the third largest expense in pork production after feed and labour. This cost area has seen significant increases across Canada over the past 5 years. In 2003 we did extensive analysis on the effect of ventilation rate and set point temperature adjustments that can save on energy costs. At the time we found losses of $1 per pig marketed were likely when a finishing barn was over-ventilated by just 10% in the winter. Today electricity prices are three times what we paid in 2003. Our opportunity for savings of up to $3 per hog marketed is possible by ensuring our ventilation systems are performing properly.

An extensive analysis of utility costs is being undertaken in a variety of barns across Saskatchewan. The initial results reported in Figure 6 show that the range of energy use is four fold across various farrow-to-finish operations. Although disappointing for those farms at the high end, it does indicate that there is significant opportunity to reduce costs incurred for utilities – at least $3-5 per pig marketed. Some of the differences contributing to these vast differences in cost include:

- Limit use of heat lamps in farrowing and move to heat mats

- Move from incandescent to T-8 fluorescent bulbs

- Reduce the number of hours of light or amount of light in nursery and grow finish rooms

- When fans need replacing select new ones on the basis of energy efficiency

Figure 6: Survey showing range in energy use across farm types

– Energy, $/100kg pig, over 3 years

Barn type No. of barns Mean Min Max

Farrow-finish 8 6.76 3.31 12.24

Nursery 2 1.70 1.36 2.48

Finish 4 1.35 0.95 2.07

Farrow 2 13.08 11.83 13.93

Farrow-nursery 2 16.21 8.93 23.06

Nursery-finish 1 2.66 1.71 4.06

Additional information will be forthcoming in this area as research uncovers the hidden profit robbers hiding in our utility bills.

Most farms don’t receive a water bill but waste here also contributes to farm costs. Scientific and industry surveys both point to the fact that about 40% of the water delivered to the nipple is wasted. This wasted water ends up as slurry and increases our manure hauling costs by at least $0.70 per pig. The things to look for:

- In a recent survey 20-70% of nipples provided flow rates in excess of recommendations. This excess water is beyond the pig’s capacity to consume it resulting in higher waste.

- Water disappearance is 34% less on wet/dry feeders compared to dry feeders and wall mount nipples.

- Nipples installed at 90o to the wall should be located at shoulder height; nipples located 45o to the wall should be 2 inches above shoulder height (a well-positioned nipple will reduce water wastage to 25% of total volume delivered).

- Replacing nipple drinkers with swing drinkers, bite-ball nipples or bowls has also been shown to decrease wastage.

Productivity

When prices are low and losses are high it is easy to turn our attention away from the demanding management of sow reproduction, “so what if we wean a few less pigs, they are not worth anything any way”. However each pig contributes to carrying the overhead of all those fixed costs our barns incur. Actually, outside of feed and trucking, most costs are fixed in our systems so the impact of sow productivity can be profound. For example, in November we completed an analysis asking what if we move from 22 pigs weaned (20.7 pigs sold) per year to 28 pigs weaned (26.3 pigs sold) per year? During this November period our breakeven price for producing a market hog dropped from $1.60/kg to $1.47/kg when looking at just the impact of sow productivity.

Conclusions

There are opportunities for savings on every farm in Canada. Finding these savings takes a methodical and careful process of comparing our targets to what we are actually achieving – doing this on a regular basis will frequently find opportunities to save. Perhaps savings of $15/hog are possible. These savings don’t all exist on all farms but some of them exist on some farms and it is our job to find them and correct them. Then next month look again and find those that escaped our gaze the first time, and be committed to doing it over and over again as we work to maintain margins in a challenging commodity market.

Pork Insight was developed to address producer and industry needs for timely and accurate information related to pork production and is designed to help you find the information to help you fine -tune your operation. The Pork Insight database can be found online at www.prairieswine.com

Survival Checklist

| Action # 1: Feeding program objectives must be clearly defined; objectives can and indeed will change over timeAction # 2: Selecting the correct dietary energy concentration can lower costs by $1 – $13 per pigAction # 3: Adoption of Net Energy system for diet formulation can reduce feed costs by $1 and $5 per pig.

Action # 4: Aggressive adoption of a variety of ingredients can reduce feed costs by up to $5 per pig Action # 5: Regular re-formulation of diets can reduce feed costs by $3 to $4 per pig. Action # 6: Tracking implementation of feed budget can reduce costs by $5 per pig. Action # 7: Cost of particle size deviation from target can exceed $1 per pig. Action # 8: In May 2006, return over feed cost was maximized in carcasses weighing 100-105 kg, in October 2007, that same farm found returns maximized in carcasses weighing 95-100 kg. Action # 9: Achieving 85% in core, rather than 66% in core would increase return over feed costs by up to $1.80 per pig Action # 10: Increased sow productivity (from 22-28 p/s/y) can reduce breakeven $13/ckg or about 10%. Action # 11: Operating procedures and equipment can both contribute to excess power consumption. Turn lights off, switch to heat mats and reduce heat lamp use. Action # 12: Improper minimum ventilation (10% above requirement) adds up to $3 per pig Action # 13: On average 40% of water delivered to the nipple is wasted, that is an additional $070/pig in slurry hauling costs. |

Pigs Down Under

Posted in: Economics, Environment, Production, Uncategorized, Welfare by admin on | No Comments

High feed prices and low hog prices have led to a huge increase in sow slaughterings in Australia and there is a low level of confidence among producers, says production consultant John Riley. Meanwhile, imports of pork products soar, including those from Canada, putting even more pressure on producers.

The winter edition of the Western Hog Farmer summarizes the Canadian industry’s response to high feed costs, the weakness of the US dollar and unsatisfactory market returns.

The dismal picture in Canada is mirrored in the Australian industry. In the last month, one of the largest production units in Queensland that is owned by a Japanese company has been put on the market. If this 7,000 sow, farrow to finish business closes, there will be serious repercussions for the local feed mill and the two abattoirs in the state.

Another company to call it a day is the breeding company Hyfarm-JSR. They have sold their 600-sow high health nucleus unit to a Dutch family who recently settled in the state. In addition, the Hyfarm-JSR multiplication unit is now on the market with limited expressions of interest by prospective purchasers.

Ironically, the Dutch family were encouraged to settle in Australia by a state government in 2002 which promoted the financial benefits of investing in the pig industry in Queensland.

The Productivity Commission report that handed down its findings in December, determined that the unprofitability of the Australian industry was not due to imports from the USA, Denmark and Canada, but was due to high feed costs.

The Productivity Commission report that handed down its findings in December, determined that the unprofitability of the Australian industry was not due to imports from the USA, Denmark and Canada, but was due to high feed costs.

In parts of New South Wales and Queensland, harvesting of the sorghum crop is well advanced with record yields being recorded. Sorghum is a summer grain crop used in animal feeds. Normally the price is around $AU160 per tonne but this year the price is holding firm at around $AU$260 per tonne due to the high demand worldwide for wheat and barley. The usual seasonal reduction in average feed costs has not materialized so far in 2008.

During the last quarter of 2007, sow slaughtering was 49.5% higher than in the last quarter of 2006. The level of imports of processed pig meat during the 12 months ending December 2007 was 29% higher than in 2006 with imports from Canada totalling 43,415 tonnes shipped weight, an increase of 24.8% on the previous year. In the same period imports from the United States increased by 52%.

The lack of confidence in the industry has resulted in very little investment in housing systems that comply with the new welfare codes. The codes dictate that within ten years, housing of sows in stalls for more than four weeks during gestation will not be allowed.

A few producers in the east that have moved to group housing in gestation have adapted grower pens and introduced feeding of small groups.

In some instances in Western Australia sows have been housed in larger groups on deep litter in shelters and fed through traditional feeding stalls on a concrete pad in or adjacent to the shelter. The feeding stalls service more than one group of pigs on a rotation system. The main disadvantage of the system is the high labour required in moving sows.

There is only limited interest in electronic feeding systems. In the past Australia’s isolation in regard to after sales services has led to frustration and a few systems that were installed in the early 1990’s were subsequently removed. However, interest has been rekindled in recent months and two large-scale producers have installed Mannebeck systems in naturally ventilated slatted floor sheds.

In addition to high feed costs and poor market returns, producers in Queensland were shocked to read in March of their state government’s proposal to increase the cost of meeting the environmental legislation. The proposal, if implemented, will see a producer with 100 sows producing bacon pigs paying $52 per sow per year to government and a producer with 600 sows with progeny to bacon will pay about $9,800 per annum. The State government has decided on a policy of full cost recovery from potential polluters of the environment for the implementation and the policing of the legislation. Interestingly a local mining company selling gold worth $108 million will pay just $20,000 if the legislation is passed.

A further major change will dictate that multi-site operations will pay the fee on every site because multi site discounts will be withdrawn. Pig producers in Queensland are far from happy and more could well exit the industry in the next six months.

Photo caption:

Group sows-1 – Producers in Australia are moving towards group sow housing